Feb'26

First time in this blog post I am writing about this month while it is going on instead of waiting for it to get over and why not.This month started with a bang. First the budget came and STT on options and Futures was increased and markets nose dived. After that India USA trade deal got signed and the markets recovered. With all this happening, came Nifty expiry day on 3rd Feb. There was huge gap up at market open, Volatility was high, premiums were high. Zerodha started acting up. Algo trades errored out because of this and were manually re-started.

In this all chaos, Nifty ITM1 Expiry day strategy took position in 12 lots instead of regular 6 lots and out of that 6 lots position was taken without any stop-loss. Didn't notice it till the market close when the actual profit was showing up more than the profit being shown on Algo platform. Made single day profit of 2.7 Lakhs which was even more than the highest monthly profit made in past months in this year. In fact, this was second best intraday trading profit in my trading journey of 6 years in absolute terms.

Last time when it happened, it was in 2022 and that profit was lost in next 2 days. That was the time when I used to trade strategies with very high risk reward. But now I have moved to more conservative strategies over the year and hoping to hold on to this profit for good.

Jan'26

A new Bank Nifty monthly strategy was started this month and as it happens whenever a new strategy is started mostly it ends in loss. Same happened with this strategy also. Along with this first time in history Sensex 10 Point with No stop loss had heavy losses on 8-Jan-26 expiry day with losses of 3921 per lot. Because of this strategy lot size was reduced for future expiries. Sensex expiry day late entry strategy with 80% SL extended the losses further in this month.

Though other strategies ended in green but none of them were outperformers this month thereby causing month to close at slight loss of -8k

Nov'25

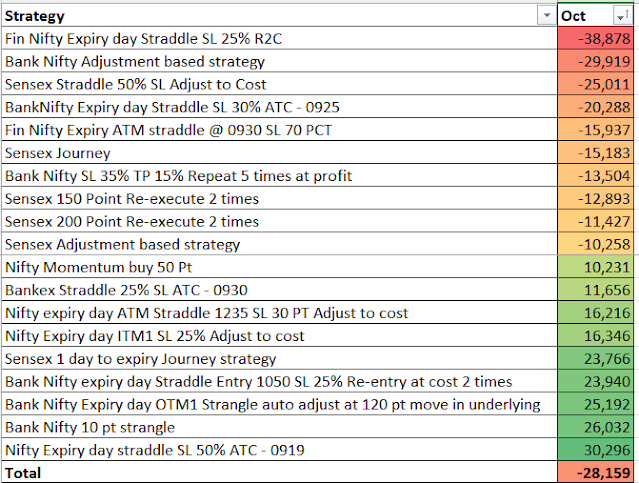

Oct'25

After being in drawdown for a lot of time, system is now making all time high on most of the days. However as the strategies are optimized for minimum drawdown, the profit %ge is limited.

Was not updating the trading journey details for past half an year, main reason being there was not much to update on performance as it was flat for most part of the half-year except for 2 months.

Completed 5 years of trading F&O in my second innings in Sep'25. Though at the start of the journey, idea was to earn crores in few years and then retire from the work but managed to barely cross 50 Lakhs of profit in these 5 years. A snapshot of the monthly performance across 5 years is as below:

Coming back to monthly updates for this half-year:

Apr'25

As there was talk of weekly expiries going on, started trading a monthly strategy of selling far OTM (1000 points away) calls and puts with a stop-loss of 100 points. However in case of positional strategy the SL some times is not effective as if there is a huge gap up or gap down at market open, stop loss will not work and huge loss can happen. And the same happened. US announced plans for 26% tariff on India and the Nifty fell by 5% at market open. This caused a huge loss in this positional strategy to the tune of one lakh and twenty thousand for 4 lots (loss of 30k per lot). This ate into all the profit which was generated by Nifty expiry day strategies thereby making the overall month flat. Sensex expiry day strategies performance was slightly negative for this month.

May'25

After bad performance of Nifty monthly strategy, lots were reduced to 2 from 4, however in this month also it hit stop-loss on both sides because of which it got stopped for next 3 months where it would have ended in profit, if continued. This month even the expiry day strategies and intra day strategies didn't perform well and were flattish. The month again ended flat thereby making 2 continuous flat months at starting of the financial year.

Jun'25

Far OTM monthly was stopped from this month. Nifty expiry day strategies as well as Nifty intraday strategy (Nifty 50 Pt) performed well in this month thereby making this first profitable month in this financial year. Sensex expiry day strategies were flattish this month also. A profit of 1,19,000 (1.08%) was achieved in this month.

Jul '25

In this month Sensex expiry days preformed well, Nifty expiry days were slightly positive and Nifty intraday strategies were in negative. Overall month ended at a profit of 89,000 (0.81%)

Aug '25

Again Sensex expiry day strategies performed well in this month. Nifty expiry day strategies were slightly green however Nifty intraday strategies were in deep red. Overall month ended flat thereby making it 3rd such month in this financial year. Seeing the performance of Nifty intraday strategies over past 4 months where they were in profit in first 2 months but then lost all of that in next months, a decision was taken to stop intraday strategies and run only expiry day strategies.

Also considering that Nifty positional strategy would have given profit in past 3 months if run, it was decided to start running from Sep month onwards.

Seeing 3 flat months in 5 months, reduced the interest in F&O options trading by a little bit and a realization dawned that it is flattish performance which can make you stop F&O rather than red months. When someone makes a loss then there is always a urge to recover it by continuing trading. But when there is flattish trajectory the interest dies down on its own.

Sep '25

This was the month when everything clicked in the place. All the strategies being run in this month ended in profit and the month ended at net profit of 2.13 lakhs after deducting the brokerage and charges.

Few strategies worth mentioning are Nifty covered call and Sensex 10 Point with no stop-loss.

I had started a covered call strategy using Nifty bees as an underlying and then selling an equivalent lots of CE options which in my case is 2 lots. Here position is taken at start of the month and in a CE option which is trading 3% away from the Nifty Spot ATM. This strategy gave profit in all 6 months of this half year which means markets have never moved beyond 3% in past 6 months on monthly basis. However this can give huge loss also once market moves more than 3%.

I was trading a low return strategy of selling Sensex 10 Point strangles on expiry day with 9 point SL. It has an average profit of 0.3% per month as per back testing and actuals. On back testing I found that if I remove the stop-loss, the profit increases. So started running the same strategy with no stop loss also. However in last week of Sep and first week of Oct, this strategy went into high losses during the day (to the tune of 3-4k per lot) but then ended the day at less loss. This is a risk as the gains in strategy over multiple weeks can be offset by 1 day of heavy losses in future.

Detailed strategy level performance for this half year is given below:

FY 24-25

Everyday expiry regime changed to 2 day expiry regime from Dec and returns in initial months after this change increased as compared to every day expiry regime. However the last month in this financial year (Mar 2025) had high monthly loss with most of the strategies giving losses with very few ending flat to slight green.

A view of returns across various months in this FY (Net returns after deducting brokerage & charges)

Feb'25 month had given good returns with all the strategies except one ending in green. However same set of strategies gave a heavy loss in Mar'25 month. Such is the uncertainty in the market.

From Dec, had started two positional strategies - started selling covered call at 3% away from on the spot price on monthly expiry day and other was selling monthly OTM 20 calls, 17 days before expiry with adjustments to be done if any option's price exceeds by 100 points. From Dec to Feb they gave profits, however because of large move in March month ended in losses.

Bank Nifty strategies were the most profit making strategies for the year with few Nifty and Sensex strategies also ending in green.

Top 20 profit making strategies for this year (based on net absolute returns)

Tried few intraday strategies from Algo test RA strategies, however they were re-try/re-execute strategies with small SL varying from 15% to 20%. It was found that their actual profit varied a lot as compared to back testing profit and hence was stopped. Though a strategy which had a MTM Stop loss with 1 re-entry worked well for Nifty and was 4th top strategy in profit.

Nov 2024

Fin Nifty: Loss of 63k

Bankex: Profit of 2k

Aug 2024

This month was overall good month and ended at net profit of 1.8k Lakhs (1.83%). A major chunk of capital (24 lots) is deployed towards Bank Nifty 10 point strangle which keeps returns on lower side as well as draw down in check. As capital increases, the risk aversion also increases.

Sensex expiry day strategies gave highest profit being followed by Bank Nifty and Nifty. Fin Nifty expiry day strategies ended flat and Bankex strategies ended in loss as detailed below:

Sensex : Profit of 1,09,539

Bank Nifty : Profit of 76,317

Nifty : Profit of 26,051

FinNifty : Profit of 5,681

Bankex : Loss of 34,667

Because of continuing losses in Bankex index, Bankex expiry day loopy loop strategy is going to be stopped and 3 new strategies similar to Sensex Expiry day strategies will be introduced and monitored.

This month Bank Nifty 100 point strangle intraday strategy generated its highest monthly profit and completed 2 years of continuous deployment. Bank Nifty Expiry day loopy loop is still leading in profits for this year and will be completing 2 years of continuous deployment at the end of Sep month. This is only intraday strategy which is running currently other than Bank Nifty 10 point strangle.

A special mention is for strategies being executed on Algo test as they returned an impressive returns of 6% this month. Have to see if can increase the capital on those specific strategies. Only draw back is that they have high SL as compared to other strategies.

This month also completed 4 years of trading in my second stint.

Jul 2024

Writing about July when already half of the August month is over, makes it tough to remember the highlights of the past month.

July month started on positive note with high intraday profits of 82k and 75k seen in first two weeks of it. By first half of July, monthly returns were around 2%. However third week started with a high loss of 80k on back of skipping SL for Bankex expiry trades. Heavy losses didn't stop at this point but 4 out of last 6 trading days of this month saw heavy losses b/w 38k to 51k which was unique to this month.

These high profits or high loss days were because of high risk high return strategies launched in Algo test which overall gave a profit for the July month. These strategies are mentioned in a separate blog post in my blog.

This month also saw a loss of 37k because of algo issues where a buy strategy was not squared off by end of day because of confusion while handling open positions.

July month ended flat from a high of 2%.

Jun 2024

Apr & May 2024

These two months were challenging because of huge spikes in Apr and illiquid far OTM PE options in May month.

In April month faced huge spikes in Nifty index on expiry days which caused SL to skip and gave huge slippages in SL hit. This caused the Nifty expiry day strategies to sustain heavy loss which contributed heavily to Apr month ending in red.

Never saw such spikes in my past 3 years of intra day trading.

When you design systems with less risk and less returns then taking stop loss within 1% of capital is essential, though these spikes caused the system to take heavy losses and it takes a lot of time to recover such losses as system is geared to take less profits every day.

Apr month recorded the highest intraday loss of FY23-24 at 1.18 Lakhs. At the end the month ended with a net loss of 90k.

May month ended in net profit of 2.57 Lakhs on the back of good performance from Fin Nifty and Bank Nifty strategies. Nifty strategies ended again flat this month. Because of this a new Nifty expiry day strategy was started as well as allocation to other 2 Nifty expiry day strategies was reduced.

There was an element of luck in May month profit as because of Election results in first week of Jun, few FinNifty, Bank Nifty and Nifty 10 to 50 point PE options became illiquid in last week of May. This caused me to take trade in few PE strikes where position cannot be squared as they had hit the high circuit and then those PE strikes gained a lot of value on counting day as market fell there by generating a huge unrealized loss. However on the day after election results came out, the market recovered and all PE options ended at 0 thereby saving the month.

Details about strategies performance for Apr & May are updated in link -> Strategy Performance Details

FY 23-24

Mar 2024

Feb 2024

Jan 2024

Sep 2023

September month started with a string of big loss days (>= 30k) and first 2 weeks were very bad. It recovered in 3rd and 4th week but average profit on green days was less than average loss on red days. Also the month ended with a big loss of around 45k on monthly expiry thereby ending the month in loss of around 61k.

Bank Nifty 100 point strangle ended with a big loss this month, its first loss month in this financial year. BN 200 point strangle also ended with a loss after recovering from its maximum drawdown in Aug month. Bank Nifty OTM1 Expiry day auto adjust strategy also ended in loss during this month.

Bank Nifty range breakout, Fin Nifty Expiry day and Sensex expiry day ended in good green this month.

Have to stop Nifty midcap select expiry day strategy this month which was started in Aug month. A new strategy Bank Nifty non directional strangle was started this month but was stopped because of losses in initial trades.

Details about strategies performance are updated in link -> Strategy Performance Details

Aug 2023

August first week started with a string of small wins and then a loss taking out all the profit from those wins. However from second week string of wins started and August ended with the most profitable month with wins on 18 days out of 22 trading days in this month. Overall profit was 3 Lakhs 12 thousand for this month which was 4.47% of ROI on capital/margin being traded.

Fin Nifty expiry day strategies as well as Nifty OTM2 strangle which didn't do that well in July month worked very well this month along with evergreen result day short volatility strategy.

Bank Nifty non directional straddle gave losses in this month with Bank Nifty expiry strategies/Bank Nifty ATM + OTM2 ending in minor profit.

Started trading in Nifty Mid cap select and Sensex expiry day strategies which are built on lines of Nifty Expiry day strategy. Have to increase the quantity to 4 to 5 lots to see how it works at higher lots.

A detailed performance of various strategies for Aug month is shown below:

Strategies performance for overall FY23-24 is as below:

Overall portfolio level parameters for FY 23-24 looks as below:

Jul 2023

July started in a different way as compared to earlier months in this financial year. It started with a string of losses but ended with a string of low profits. Continuous winning streak reached to 9 at the end of this month helping in achieving all time high for the overall

portfolio after being in drawdown for 38 days. This helped in achieving highest monthly profit of 73k in this financial year (FY 23-24). This month also recorded highest intraday profit of this FY on 6-Jul (58.4k) .

Star strategy for this month was Result day based short volatility strategy which grossed 68k on its own. Profit wise this is huge as it utilizes overnight margin only and hence needs half of the margin maintained overnight in cash to avoid interest.

Bank Nifty 100 point strangle continued its winning streak for this month also again touching multiple all time highs in this month. A special mention can be given to Bank Nifty OTM1 Expiry day strategy which also gave good profit after a dismal performance in May month.

However Bank Nifty 200 point directional strategy gave highest monthly loss for this FY because of morning volatility as seen in this month and went past its maximum historical draw down. Fin Nifty Expiry day as well as Bank Nifty expiry day ITM1 strategy also underperformed in this month and brought the overall profit down.

Two new Bank Nifty buy strategies were started in this week - One is based on Bank Nifty Range break out which is shared on my blog and other is based on combination of indicators. This was done mainly to offset losses in non-directional strategies BN ATM+OTM2 and Bank Nifty Straddle adjust profit making leg.

Day wise PnL for Jul month

Strategy wise performance for FY23-24 as of Jul end

Jun 2023

As has been the case with Apr and May this year, again the month started good with most of the days in green in first 2 weeks and the monthly profit touched all time high of 1,13,884(1.8%) on 19-Jun but in third week huge losses happened first on Tuesday and then on Thursday which brough the profit down and the month ended at a profit of 68,900 (1.1% profit).

Three new strategies were started this month to utilize more trading capital on non-expiry days:

1. BN ATM + OTM2

2. Fin Nifty Expiry day 10 point strangle

3. Nifty Intraday Non directional OTM2 Strangle

BN ATM + OTM2 performed well and ended the month at 2.8% after deducting brokerage/charges. Fin Nifty Expiry day 10 point strangle ended negative and Nifty Intraday Non directional OTM2 strangle was at break even for the month.

However highlight of this month was BN 100 Point strangle which made a profit of 8.3k per lot (4.6%) even after deducting brokerage and charges.

Expiry specific strategies such as Bank Nifty Expiry day ITM1, Bank Nifty Auto adjustment strangle and Nifty Expiry day 1235 ATM straddle ended in red this month thereby bringing down the overall portfolio return.

Day wise PnL for Jun month

Strategy wise performance for Jun 2023

Strategy wise performance for FY23-24 as of Jun end

May 2023

This month started on a positive note with the monthly profit reaching to 1.5% of capital by 17th May (ATH) at which point I came out of 103 days long draw down. However that moment was short lived as another drawdown started just after that with string of losses. At the month end the overall profit settled at 37.7 k (0.6%) of overall capital at start of May month.

Result day short volatility strategy again performed well in this month and came up as the most profitable strategy for the month. Fin Nifty expiry day was close behind as second most profitable strategy. This month was not that good for Bank Nifty expiry day auto adjustment strangle and it was the most loss making strategy in this month. Nifty expiry day 1235 ATM straddle again continued to disappoint in this month also as in previous months of this year. Bank Nifty 200 point strangle closed in green after a dis-appointing performance in previous month.

No new strategies were deployed this month and no old strategies stopped in this month.

Apr 2023

As it is a long weekend because of 1-May and don't have any good web series or TV shows left to watch, here I am reflecting on the Apr month.

The month started well with winning streak in first week of this month. Second week was ok with no big losses but then on 13-Apr the Finvasia issue happened which caused few ghost trades to be executed. Though I didn't have any loss because of that, strategy basket had to be revised to minimize strategies being executed on Finvasia platform. From 17th Apr, Bank Nifty 200 point strangle started giving more losses as compared to profit and as this was one of the strategy for which lot size was increased to 10 from 5, it brought down the overall profit for the month. It was observed that on most of the days, market was not able to hold a trend and used to reverse either in first hour itself or during the day which was not conducive for Bank Nifty 200 point strangle strategy.

Result based short volatility strategy worked well in this month thereby giving a good profit for just 1 lot. May be it is time to increase it to 2 lots from next earnings season but then historically I have seen that mostly when lots are increased on a strategy it starts its drawdown period from that point.

At the end, Apr month ended at 50k of profit which was 0.8% of return on the trading capital.

FY 22-23

Month - Jan 2023

Jan 2023 monthly performance

Gross Profit of 2,71,227

Net Profit of 2,47,000 (3.4%)

FY 22-23 Profit at 10.7%

Equity curve at ATH

Strategy wise performance

Trading parameters for all years in month

Month - Oct 2022

This month built on the changes done in Strategy basket in Sep'22 and became the most profitable month in this year (Net profit of 2,19,419, 3.2% return on 68.3 L margin). On monthly closing basis profit reached all time high though on daily closing basis the drawdown is still there. Last ATH on daily closing basis was on 15-Feb-22 (22.03 Lakhs) which is still to be achieved. Incidentally 15-Feb-22 was the day when I made maximum intraday profit of my systematic trading journey (2.78 Lakhs/ approx 7% return on capital at that point) and then lost it in next 2 days of trading.

Equity curve as of October end (Monthly closing basis)

Below were the changes which worked:

1. Deployed only 40% of capital on non-expiry days and using max capital on expiry thereby increasing the probability of profit

2. Diversified expiry day setup strategies (Introduced 5 more expiry setups)

3. Discontinued loss making strategy having high drawdown (BN Inverted strangle)

4. After introduction of expiry day setups (point 2) discontinued BN 20 Point strangle as it was giving same kind of returns as expiry day setup in back testing but was an intraday strategy thereby causing high brokerage

5. Limited max lots per strategy to 4. In case lots to be increased in a strategy, changed the strategy by introducing TSL (BN 100 pt strangle re-execute) or by spacing the entries at different times (Expiry day BN Straddle Re-entry 2 times). This helps in minimizing the drawdown.

6. Last but not the least factor- Luck. Strategies which were introduced in September performed well in October. Have had cases where strategy who were performing well before deploying in back testing have gone into draw down from the time they were deployed. Even if strategies were doing good in back testing because of execution issues there were losses to the tune of 1,20,000 . October was a month where not many execution issues happened.

Strategy wise view of Gross/Net profit for October month

This will give a view of charges being incurred by various strategies. Now few strategies are executed in IIFL (BN 100 Point strangle ones) , few in Zerodha (Mostly expiry days one) and all others in Finvasia so their brokerage and hence charges (Note GST is 18% of brokerage + Transaction charges) differ accordingly.

IIFL Brokerage - Rs 5 per lot

Zerodha Brokerage - Rs 20 per order

Finvasia Brokerage - No brokerage

Month - Sep 22

FY 21-22

My first year of system trading ended well. Made 45% returns (18 Lakhs) after including all charges. Executed around 22 different strategies using back testing from stockmock_in and execution engine from @Tradetron1 .More than profits it was journey which was more interesting

Three strategies which performed very well with very less drawdown - Nifty straddle (provided 53% return in 8 months), BN range breakout buy - provided 32% return in 4 months and NIFTY Far OTM selling

Hello. Came across this amazing jounral of yours. Have been going through it for hours and hours. One question that I had was that if it is really worth all this effort?

ReplyDeleteThere are two kind of activities in which people spend their effort - one in activities to earn money and other in activities which interest them. This is second kind of activity which I do out of interest only so haven't thought whether it is worth or not. May be I will leave it if I suffer losses or interest fades out in future.

DeleteHi Arun Sir... thanks for sharing the most valuable details.. where can i find the stratefies entry and exit timings pls

DeleteMost of my strategies are listed in main blog arunstrategy.blogspot.com. It has various pages detailing out the different strategies with their entry/exit time as well as Stop-Loss details

Delete